While Alrosa, the Russian diamond miner, expects diamond demand to bounce back by July or August mainly in China and other Asian markets, the jewelry luxury market will need at least three years to get back on its feet, to 2019 levels, Bain & Company, expecting the market to shrink by 20–35% and forces luxury players to jump into the future heads on.

What we are witnessing now is the end of fine jewelry as we know it.

“WE’RE TRYING TO FIGURE OUT HOW WE FINANCIALLY SURVIVE THIS”

While traditional brick and mortars and department stores have seen sharp declines due to the unprecedented crisis and global lockdown, online luxury has remained resilient. Every jeweler from mom-and-pop local shops to the globe-spanning brand, the likes of Tiffany & Co are brainstorming on how to improve their online sales platforms to offset the shutdown of physical channels.

Back in March, in an interview with Lane Florsheim, Wall Street Journal, David Yurman revealed “We’re trying to figure out how we can actually still do business in this environment, we’re trying to figure out how we financially survive this.” The 40-year old brand, which generates an estimated $650 million in sales each year, is expected to take some of the hardest hits as a result of the spread of COVID-19.

Predicting the future with any certainty is risky at best. However, I believe the jewelry market will react, will react differently, characteristic of its distinct business model criteria.

While 2020 will be bad, I see a faster and swifter rebound than most brands, with strong dynamics already in the second half of 2021 and a steady growth dynamic from 2022 onward.

Given that the market is mainly relevant for the performance of a brand’s recognition, not all brands are impacted in the same way. Some will rebound, and some won’t.

My approach to the analysis for the present situation is asymmetric in essence. Beyond simply a demand crisis, in which consumers are spending less because of an economic recession, there are additional factors to consider. No one knows how long the COVID-19 will last and how deep it will cut, but what we know for certain is that it is worse than any recession we’ve witnessed so far.

CONSUMERS ARE JOBLESS AND IN FEAR

First, consumer behavior has changed dramatically. Consumers are in fear, and rightly so. Most are still focusing on essentials, leaving many fashion retail stores, restaurants, and coffee shops with dramatically less foot traffic than before.

Others are afraid to lose their jobs, or they have already. Those consumers will be — most likely — out of the luxury market for some time. However, there will be many who won’t be affected significantly, especially at the top-end of the market. Hence the jewelry sector, in particular at its high-end segment, will be much more robust than other segments, especially those poorly defined brands “in the middle.” For many of these brands, there will be no future.

Given all these uncertainties, it’s time to refocus on luxury as extreme value creation. Is your brand positioning strong enough? Are you creating value versus your nearest competitors? Do consumers have a reason to come to you? Address your gaps now, forcefully, before it is too late.

Second, in many sectors, there is a supply crisis. Does this mean that the luxury market as we know it is dying? Consumers won’t want to buy luxury anymore? And the fine jewelry market will become more stealthy, less conspicuous?

WE LIKE TO INDULGE OURSELVES

The answer is no! At least not as a general tendency. Yes, some consumers will change their preferences, if not for some time, and many consumers will temporarily drop out of the market. But this does not mean that the fundamentals have changed. The reasons why consumers continue to buy luxury jewelry have never changed — through no crisis, no war, no disruption.

Expect disruption and change to continue, only at an accelerated speed. The present crisis does not change the fundamentals, but it accelerates the changes that were already visible before. And it will make consumers think twice: they will scrutinize your brand, and you better entice and “wow” them with what you do, otherwise, they will turn AWAY to fresher, more relevant brands.

We want brands that connect with their purpose and deliver unforgettable experiences, unapologetically. Some people will always want to indulge. They want to be inspired and are seeking brands that provide them with something extraordinary, something with extreme value. They want brands that communicate with them in relevant ways, even through the crisis. Brands that make them proud, brands that entertain them, brands that are very good digitally — and not for beginners, but digital natives.

If you are not excellent on your digital journey, you need to change now. This is the advice jewelers need to follow in times of crisis. Focus on creating an unforgettable experience for your customers. Create extreme value for them every day. This will lead consumers when they are ready to spend.

SPREAD THE BRAND

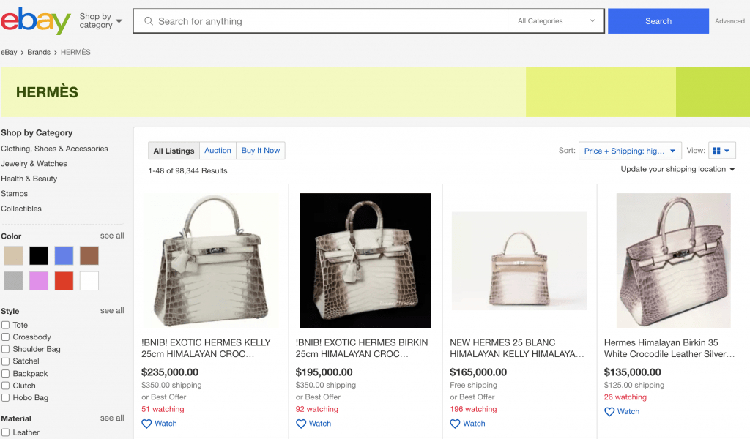

Equally important, focus on your reach. Big brands entail huge advertising budgets that will ultimately result in significant power of converting audiences to their e-platforms. Fortunately for the rest of us, we have gigantic virtual malls. Amazon, eBay, Etsy, and less conspicuously Instagram and Facebook, are all pushing quietly towards the luxury market.

As a matter of fact, brands that attempt to replicate the services they lost by ditching Amazon, for example, may find it impossible. Amazon’s logistics and shipping operations, site traffic, and mountains of shopper data are hard to match, even if you’re a well-known brand like Gucci.

THE CHANGE IS EVIDENT

It was very evident for us, Davvia. These unprecedented times refashioned our customer behavior in bounds and beyond in a swift and extraordinary way. Davvia is a leading end-to-end jewelry services agency, in short, we support jewelers and jewelry startups to create extreme value by developing solutions from unique collections creation, production, and distribution to e-solutions.

By the start of 2020, business stalled as the COVID-19 pandemic took its toll on the industry. However, come the end of March, a clear shift started to emerge. Instead of revamping their collections, stocks, and offerings, more than 50% of our client base was intent on a complete overhaul of their digital presence. New e-platforms, social tools, e-stores. A total digital transformation. The competitive landscape is changing drastically.

TIME FOR VISIONARIES

For those brands that are managed by controllers, rather than visionaries, you will be missed. Brands that are choosing to focus on cost management while forgetting about their customers will be easily forgotten.

The playful, witty, optimistic, and bold brands that excite through compelling brand stories will connect deeply with their customers, and above all, create value most extremely. There is no alternative to excellence when times get tough. It is an opportunity, even an obligation for brands to redefine themselves, reconnect, and reinvent to indulge, inspire, and innovate.

The time for fine jewelry is now.